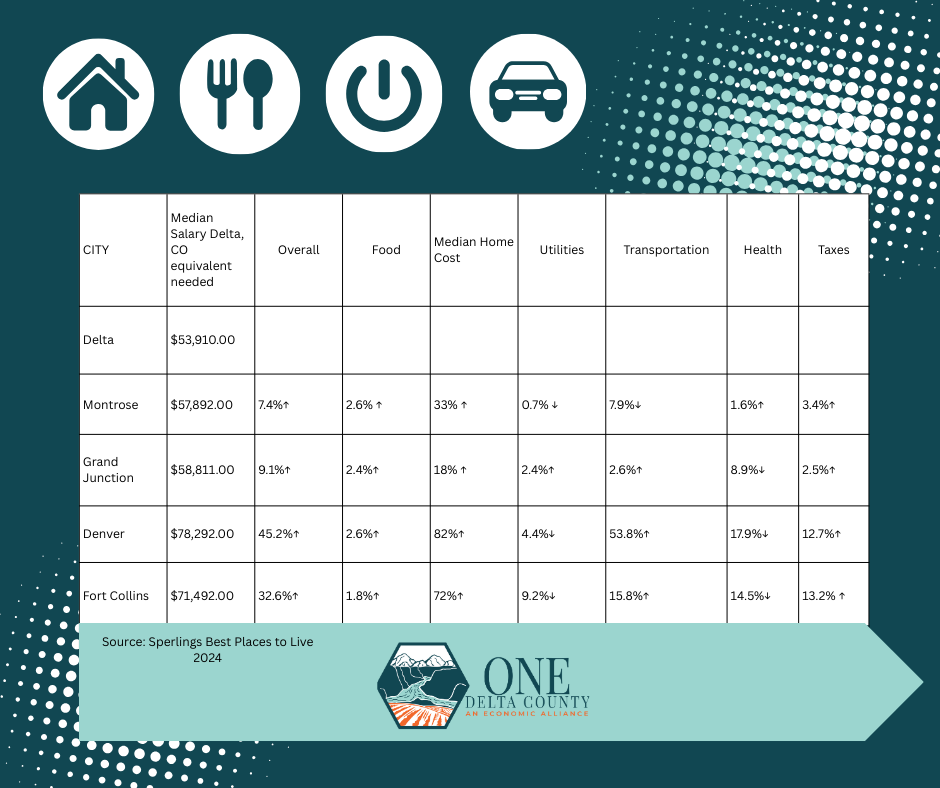

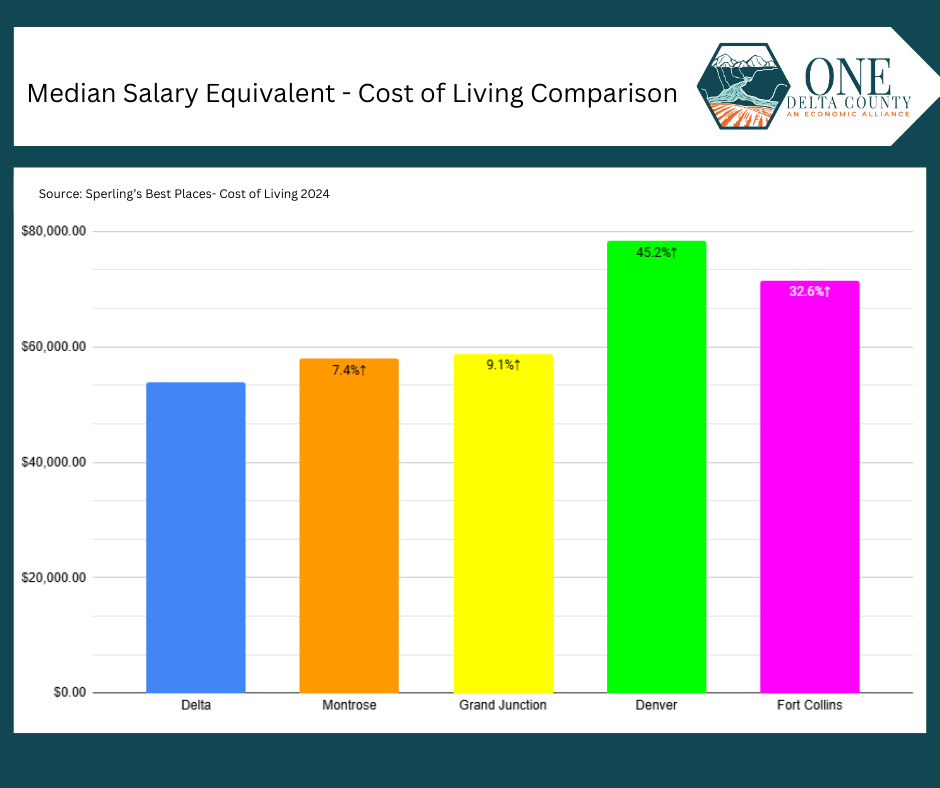

Those of us who call Delta County “home”

enjoy a very high quality of life at a low cost.

Surrounded by scenic beauty and a temperate climate, we enjoy 242 days of sunshine. Whether you want to go play in deep snow, fish in mountain lakes surrounded by Aspen trees, bike, hike or 4-wheel in the desert, or walk through fertile farms, orchards and vineyards, it is all close by. No traffic, a laid-back lifestyle, affordable real estate, high-speed internet, and new business opportunities combine to create a great place to live, work and play.